Why New E-Invoicing Mandates Won’t Deliver the AP Efficiency Gains You’re Expecting

New e-invoicing mandates are coming. How prepared is your business?

Wherever you are in the world, if you work in Accounts Payable, you’ve heard about the incoming wave of e-invoicing mandates. You may even have done some thinking around how they’re likely to affect process efficiency (spoiler: probably not enough).

Here’s what many organizations are missing: a slew of these new mandates are actively targeting AP processes, where historically they’ve focused on AR instead. That means that, for the first time, AP is front and center in the mandate rollout.

The impacts are taking many businesses by surprise. Especially if they’re assuming that government-mandated e-invoicing automatically equals efficiency.

Understanding the Scope of New E-Invoicing Mandates

A quick primer: In the coming months and years, new government e-invoicing requirements are set to roll out globally. Among the countries planning to enact these mandates in the very near future are:

- Croatia – B2B e-invoicing from January 2026

- Poland – B2B e-invoicing from February 2026

- Belgium – B2B e-invoicing from January 2026

- France – B2B e-invoicing from September 2026

- The UAE – B2B e-invoicing from July 1 2026 (pilot), followed by a full rollout in January 2027

The primary driver is tax compliance, specifically it is a move to increase VAT collection and processing efficiency, as well as combat fraud. An expected side effect is better business process outcomes. But is that realistic? Let’s unpack.

Expected Efficiency Impacts. Or Not.

At the start of the recent SSON AI-Powered AP webinar, participants were asked their opinion on the issue with the following poll:

“Do you believe government mandates around e-invoicing will:

A. Help A/P to improve processes and efficiency?

B. Hinder A/P processes and cause problems?”

Out of 49 respondents, 65% said “help” and only 35% said “hinder”. Not surprising when you consider that many already know the benefits of automation: high STP and touchless invoice processing and the ability to process higher invoice volumes per FTE.

Clearly, the perception amongst the majority of AP professionals is that government-standardized automation will bring the same benefits as the automation used on the business end. But according to Avalara’s General Manager of E-invoicing, Matt Hammond, that’s unlikely:

“A lot of the benefits that we associate with e-invoicing, particularly as it relates to Accounts Payable, are predicated on the fact that it’s come from automation providers who own both sides of the transaction. So, effectively, the buyer and the supplier are on the same solution. That allows them to perform different functions in the background that people don’t actually see, which is where a lot of these benefits originate from.”

A clash of priorities

Once part of the equation shifts to a government standard, many of those benefits could disappear. Matt points out that governmental priorities are rarely the same as those of your business. Validations done by the government, he notes, are generally for tax purposes alone.

Meanwhile, issues like whether an invoice is sent without or with the wrong purchase order, are less relevant. The same goes for ensuring that correct PO line numbers are present or that correct units of measurement are used. In short, many of the efficiencies that AP automation is predicated on aren’t built into the framework for government-led e-invoicing. They simply aren’t at the top of the list of considerations.

“I don’t think people right now, today, appreciate the lack of control they’re going to have on the incoming invoice when these mandates go live.”

Matt Hammond, General Manager of E-invoicing

Avalara

Technical difficulties

Jasna Janjic, Solutions Architect at Springtime Technologies, points out another layer of complexity: “[New mandates] mean there’s the need to manage multiple APIs to go to multiple gateways.”

In practice, this means organizations that operate in multiple countries will be faced with the ongoing headache of needing to update APIs for each government system and maintain multiple integrations.

Another challenge is that some data fields on government portals are not mandatory — meaning suppliers can choose to leave those fields blank. The result is that the information needed for touchless processing may be missing from your documents. Again, this stems from the fact that governments don’t necessarily care whether the non-tax data on your invoice is correct, and it has the potential to wreak havoc with well-oiled automation.

“I think there is certainly a challenge on the horizon…There are benefits if you get the right systems and processes in place, but they won’t come off the bat. And they won’t come without going through a period of change management with yourself and with your suppliers.”

Jasna Janjic, Solutions Architect

Springtime Technologies

Meeting the E-Invoicing Mandate: How AI and Strong Partnerships Drive Success

One thing is crystal clear— new e-invoicing mandates are set to have an outsized impact on AP efficiency. In fact, by the end of the SSON webinar, many of the polled participants had messaged the presenters to say that they’d changed their mind from option A “help” to B “hinder”. You can view the report here and download the webinar slides here.

One thing is crystal clear— new e-invoicing mandates are set to have an outsized impact on AP efficiency. In fact, by the end of the SSON webinar, many of the polled participants had messaged the presenters to say that they’d changed their mind from option A “help” to B “hinder”. You can view the report here and download the webinar slides here.

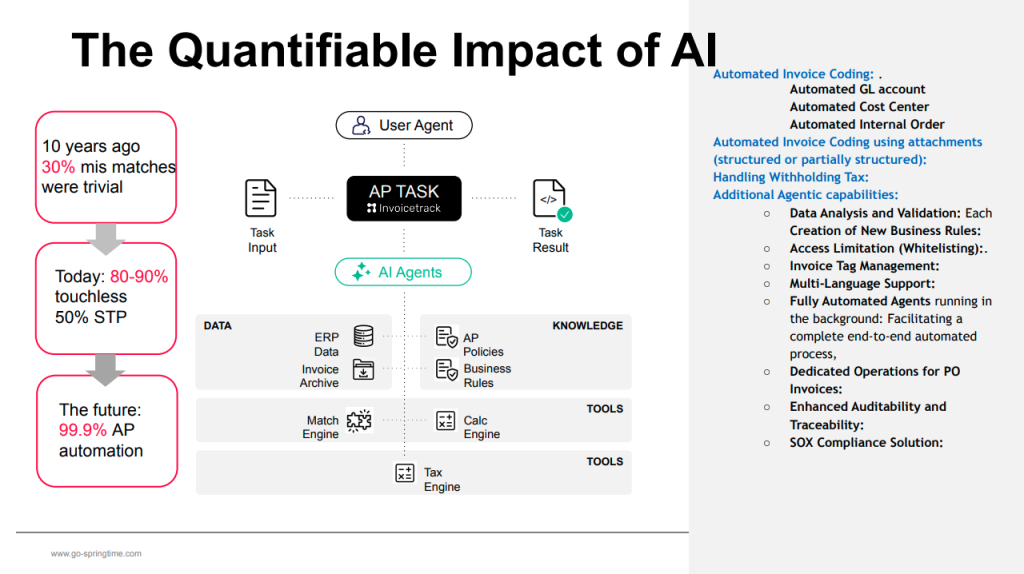

What’s also clear is that, for companies to thrive in this new landscape, their AP processes are going to need to adapt in lock-step with the planned changes. Fortunately, this is an area where agentic AI can be a game changer.

Agentic systems provide the contextual understanding needed to tackle the core challenge the new mandates present: dealing with inconsistently structured data. For example, using agentic, companies can autonomously review past invoices from their suppliers to identify the correct data needed to match new invoices with POs. Even if it’s spread across different fields from historical examples. Similarly, faced with unit and currency variations, agentic systems can quickly adapt to ensure AP automation continues to run smoothly.

Along with these AI advancements, strong software partnerships between providers will be the key to ensuring AP processes continue smoothly when faced with multiple portals and APIs. Jasna Janjic sums up:

“Partnerships like the one between Springtime and Avalara are going to be crucial for end users as we move ahead with e-invoicing. With our platform, all of the APIs that need to be connected to government gateways are handled, thanks to our integration with Avalara. Meanwhile, Springtime’s AI works in the background, augmenting any data that’s needed as new invoices come in based on past history. All of which means it’s just business as usual for AP.”

Interested in how to future-proof your AP processes against e-invoicing mandates? Our team would be happy to walk you through it. Let’s talk.