Breaking the KPI Ceiling: How Agentic AI is Redefining Touchless AP Processing

Despite two decades of AP automation and widespread adoption, finance leaders are confronting an uncomfortable truth: Has automation has stalled?

Traditional tools including OCR, RPA and template-driven workflows, have delivered incremental gains, but KPIs such as touchless invoice processing, exception rates, and cost-per-invoice seem to have hit a wall.

This is something we explored during a recent webinar and in an exclusive report in partnership with SSON. Both confirm this clearly:

- 76% of AP teams report less than 50% automation in their P2P processes.

- Only 3% have surpassed the 70% touchless processing threshold, despite investment in automation platforms.

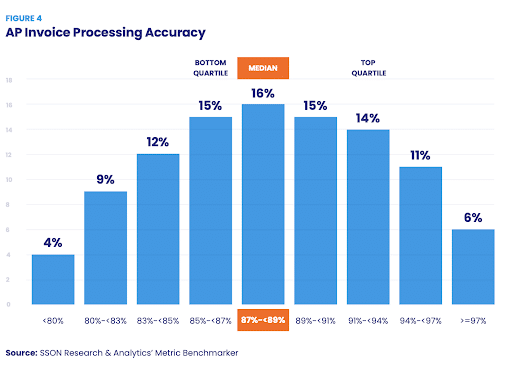

- AP accuracy has plateaued with 71% of organizations achieving less than 90% accuracy.

Ardent Partners reports that AP exception rates generally remain above 22%, the single largest barrier to automation progress.

reports that AP exception rates generally remain above 22%, the single largest barrier to automation progress.For CFOs under pressure to reduce operating cost and improve audit readiness, this plateau is no longer acceptable.

The result?

A KPI ceiling that even the most advanced finance functions are struggling to break through using traditional automation alone.

Springtime Technologies is challenging that ceiling.

1. The Automation Paradox: High Adoption, Limited Progress

Automation is everywhere, yet GBS and finance leaders continue to report:

- High exception volumes

- Slow, inconsistent workflows

- High dependency on manual validation

- Increased compliance complexity

- Plateauing KPIs despite “automated” processes

Exception handling is often cited as the number-one obstacle to AP efficiency for AP teams.

This is what GBS leaders call “the last mile problem”: automation handles the easy part, but exceptions, variability, and governance-heavy processes still require humans. And those exceptions are precisely what slow AP down.

Even in high-performing global shared service environments, touchless processing remains stubbornly low and is frequently stuck under 50%.

2. Why Traditional Automation Hits a Ceiling

Legacy AP tools were built for structured data and predictable workflows.

But real-world AP isn’t predictable.

The biggest barriers to progress include:

- Mismatched POs

- Missing or incorrect GRNs

- Non-PO invoices

- Supplier formatting variations across countries

- Multi-entity ERP complexity

- Tax + e-invoicing mandates creating new exception layers

SSON’s analysis shows that exceptions are now the single largest contributor to AP inefficiency, impacting invoice processing time, cost-per-invoice, and supplier satisfaction.

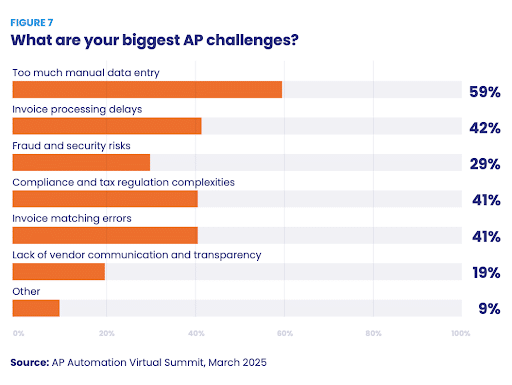

Manual data entry, matching errors, compliance friction, and invoice delays all rank in the top five AP challenges for 2025.

Traditional automation, RPA especially, struggles here because:

- It cannot reason.

- It cannot infer context.

- It breaks when a format or rule changes.

This is because invoice data is inherently probabilistic, not deterministic, and suppliers frequently change formats, line structures, and tax elements. Country-specific e-invoicing mandates create additional format drift, further breaking rule-based systems. RPA cannot handle these dynamic conditions because it is rule-driven, not context-aware.

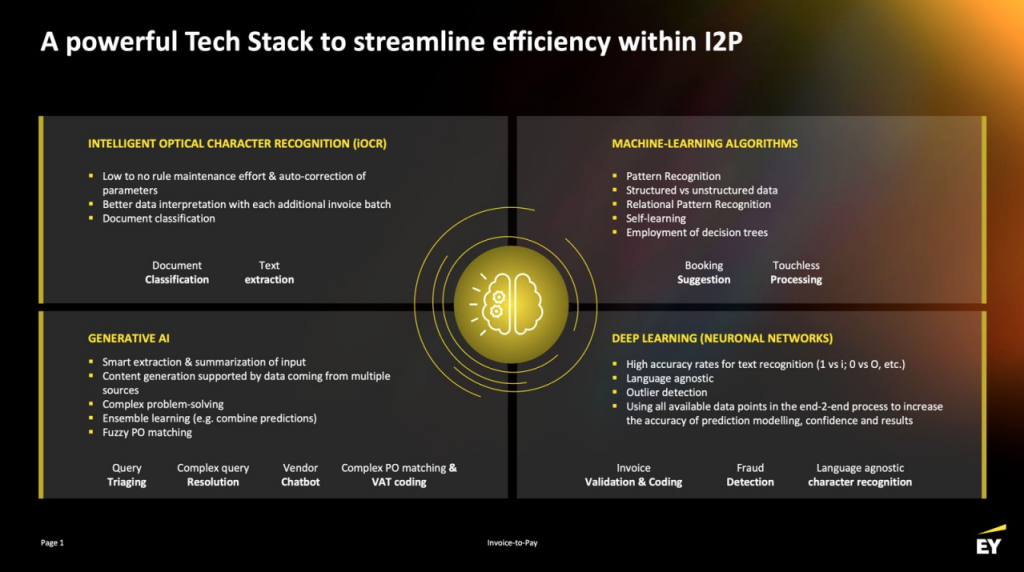

Agentic AI, by contrast, simulates human reasoning, interpreting intent, context, and historical resolution patterns, enabling it to act autonomously where traditional automation fails.

Which is why accuracy rates have flatlined.

This is the KPI ceiling.

3. AI Creates a Step Change - but Agentic AI Breaks the Ceiling

Traditional AI: focuses on prediction, extracting data, classifying fields, flagging anomalies, and identifying patterns. It improves accuracy but still relies on humans or fixed workflows to take action.

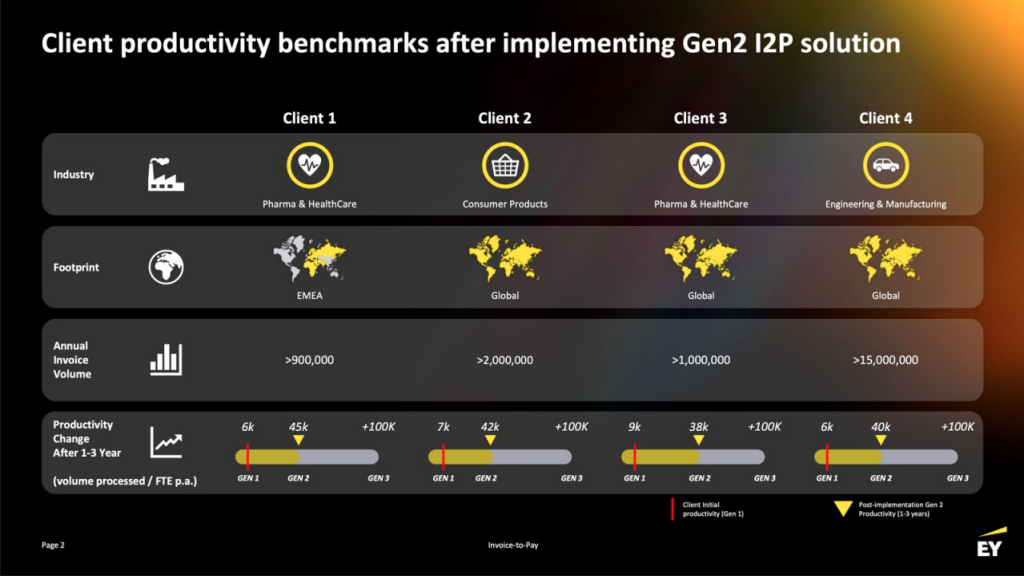

AI changed the game by introducing learning and adaptability, pushing KPIs up towards:

- >90% touchless processing

- >95% first-time match rates

- 50–60% reduction in invoice processing cost

Agentic AI: by contrast, performs autonomous execution. Agentic systems break down tasks into multi-step actions, call other systems, update records, resolve exceptions, and continuously optimize processes. Instead of merely interpreting data, Agentic AI thinks, then acts on it, functioning as a digital operations layer across AP.

What makes Agentic AI different?

Unlike standard AI, which predicts or classifies, Agentic AI acts. It can:

- Handle exceptions dynamically

- Reason through ambiguous or incomplete data

- Cross-check master data to resolve mismatches

- Adapt to new invoice formats

- Navigate multi-country e-invoicing rules on the fly

- Continuously optimize workflows

- Trigger actions within ERP and AP systems autonomously

Agentic AI isn’t simply a “better automation tool.” It represents an entirely new operating model.

4. Agents in Action: The New Frontier

Nearly 30% of organizations have already applied Agentic AI to the P2P process, emphasizing that AP is a prime testing ground for autonomous agents.

Where older automation focused on discrete tasks, Agentic AI orchestrates the entire AP lifecycle.

Examples of Agentic Capabilities

Autonomous Exception Resolution

AI agents are now able to resolve the bulk of invoice exceptions automatically. They analyse incoming invoices, identify discrepancies (price, quantity, tax, PO mismatch), and through learned reasoning and by referencing historical behaviour, agents automatically resolve routine exceptions, PO data, GRNs, and supplier contract terms. They only escalate genuinely complex exceptions to humans.

In global SSCs with >500k invoices/year, exception handling often consumes over 50% of processing effort. AI agents allow AP teams to scale without adding FTEs, even during M&A integrations or seasonal volume spikes.

For large enterprises with high exception rates, diverse suppliers and complex multi-ERP landscapes, agents can help to deliver faster cycle times, more touchless processing, and fewer bottlenecks.

AI-Driven Supplier Inquiry Handling

AI agents act as a “supplier concierge,” ingesting incoming supplier emails, automatically answering invoice-status questions, sharing payment dates, validating bank details, and escalating only when required. This is a 24/7 operation processing responses from global suppliers in their own time zone, and language, helping to reduce email backlogs, improve first time resolution KPI’s and cement stronger supplier relationships.

Intelligent Compliance, Fraud Detection & E-Invoicing Control

AI agents continuously monitor invoice, and payment flows to detect abnormal invoice and payment patterns such as irregular bank details and duplicate invoices. Agents will also enforce CTC/ e-invoicing compliance rules, and ensure tax, VAT, and local regulations are adhered to before invoices reach the ERP.

For multinational organisations, agents can help mitigate risks around incorrect tax coding, duplicate payments, and fraud, while helping AP teams comply with complex regulatory requirements across multiple regions.

5. Agentic AI: New limits for GBS KPIs

With 47% of organizations implementing AI agents already seeing a 10% or above impact with 9% over 25%, agentic AI is significantly incremental, shifting AP teams further towards proactive, operational leadership and AP utopia.

- Significant drops in exception workloads

- Faster compliance validation

- End-to-end compliance assurance even as mandates increase

- Real-time visibility into process performance

- Scalable, multi-entity, multi-country orchestration

- Stronger supplier trust and fewer payment disputes

- True labor optimization

Agentic AI Also improves the KPIs GBS leaders care about most:

- Cost per invoice reduced by up to 60%

- Labor cost per invoice falls as exceptions decline

- Higher STP rates

|

KPI |

Agentic AI |

|

Touchless processing |

>95% |

|

Exception rate |

<5% |

|

Cost per invoice |

$2-$4 |

|

Total Cycle time |

3-5 days |

Perhaps most importantly for GBS leaders and CFOs, headcount can be redeployed into governance and analytics rather than invoice firefighting.

6. The Future of AP Is Autonomous

In response to the restrictions of traditional automation, agentic AI is emerging as a necessary evolution capable of near-human reasoning and problem-solving. Whilst implementation is cautious, early adopters are reporting that preliminary results are exciting, enabling AP teams to reach higher automation levels, even in fragmented and fast-evolving and complex environments.

At scale, this the impact is transformational-both operationally and financially.

Already an increasingly valuable intelligence layer for the entire finance organization, AI agents will further propel AP to be a self-improving system powering GBS efficiency, supplier relationships, and enterprise-wide performance.

Ready to Break Your KPI Ceiling?

Springtime Technologies’ Invoicetrack is built for large, complex, multi-entity enterprises that have outgrown traditional AP automation.

If you’re ready to:

- Reduce exception volumes

- Improve STP rates

- Navigate e-invoicing mandates

- Lower cost-per-invoice

- Increase operational scalability

- Modernise your AP operating model

Invoicetrack can get you there.